Key Takeaways:

- Understand the fundamental differences between ETFs and mutual funds.

- Assess your financial goals and risk tolerance before investing.

- Be aware of fees, tax implications, and trading strategies associated with each investment type.

Introduction to ETFs and Mutual Funds

Investing in Exchange-Traded Funds (ETFs) and mutual funds is a cornerstone strategy for both new and seasoned investors. These investment vehicles allow individuals to diversify their portfolios, access professional management, and tailor their risk and reward strategies. Still, each type comes with its own structure, costs, and operational mechanics that can dramatically impact your investment outcomes. Before diving in, it’s vital to compare ETFs vs mutual funds to see which aligns best with your financial goals and habits.

Making informed choices starts with understanding how ETFs and mutual funds operate in real-world markets. ETFs are known for their tradability and typically lower expense ratios, while mutual funds often offer broad diversification through pooled funds and active management. Their contrasting approaches to trading, fees, and taxes may affect your portfolio growth and your investment experience.

Both options are widely available through brokers and financial institutions, with thousands of choices ranging from broad market trackers to niche investment strategies. This diversity can empower investors, but it also underscores the importance of due diligence. Knowing how these funds work and how they differ can prevent costly missteps.

Equally important is to consider your financial profile, timelines, and tolerance for market swings. The right investment vehicle should suit your needs, be it hands-off growth, active management, or tactical flexibility.

Key Differences Between ETFs and Mutual Funds

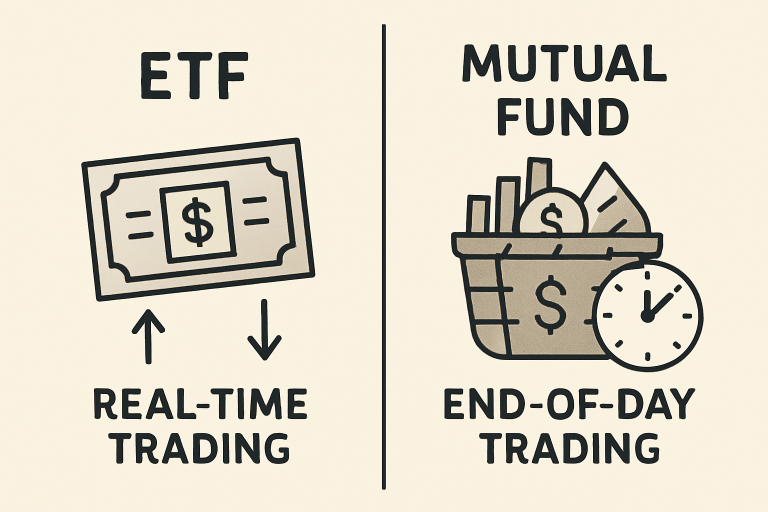

- Trading Flexibility: ETFs can be bought and sold like stocks throughout trading hours, allowing investors to react to market changes in real time. Mutual funds, on the other hand, only allow trades at the end of the trading day, based on that day’s net asset value (NAV).

- Cost Structure: ETFs generally offer lower expense ratios compared to mutual funds, due to their passive management style and operational efficiencies. However, mutual funds may charge sales loads or require high minimum investments, which are rare with ETFs.

- Tax Efficiency: Owing to their unique structure, ETFs typically incur fewer taxable capital gains distributions, making them a tax-savvy option for investors. Mutual funds frequently distribute capital gains annually, which can create unwanted tax bills even when you haven’t sold any shares.

Assessing Your Investment Goals and Risk Tolerance

Before allocating your money, take a step back and evaluate your financial objectives. Are you investing for retirement, saving for a major expense, or seeking current income? How do you handle market downturns? Do you embrace risk, or does market volatility keep you up at night?

These questions help define your investment time horizon and the level of risk you’re comfortable assuming. ETFs may suit investors seeking low costs and trading flexibility, while mutual funds often appeal to those wanting a professionally managed, set-it-and-forget-it approach.

Understanding Fees and Expenses

Investment expenses play a pivotal role in long-term success. While it’s true that ETFs usually offer lower annual expense ratios than mutual funds, it’s important to remember potential trading costs unique to ETFs, such as brokerage commissions and bid-ask spreads. Mutual funds may levy front-end or back-end sales loads, and could require higher minimum investments.

According to a report by the Associated Press, the average expense ratio for stock mutual funds fell to 0.42% in 2023, while stock ETFs dropped to 0.15%. These trends are driven by a shift toward index investing and the large scale of such funds, which helps further reduce costs. Investors should be vigilant, as even small differences in annual expenses, when compounded over years, can make a significant impact on overall portfolio value.

Tax Considerations

One of the biggest differences between ETFs and mutual funds is how they generate taxable events. ETFs, due to their structure and in-kind redemptions, generally have fewer capital gains distributions.

This creates a tax advantage over mutual funds, which may realize and distribute capital gains through portfolio rebalancing or investor redemptions each year, creating tax liabilities irrespective of whether you’ve sold any shares. Investors with substantial taxable accounts should weigh these factors carefully to minimize their annual tax burden.

Common Mistakes to Avoid

Avoiding common pitfalls can save you from unnecessary losses. Chasing funds with strong recent returns often results in buying high and selling low. Failing to diversify or understand the underlying assets, especially with complex or sector-specific ETFs, can introduce risks that outweigh potential rewards.

Be cautious of hidden fees, overconcentration, and illiquid or expensive niche strategies. As CNBC highlights, many investors fall into traps, such as misjudging ETF liquidity or misunderstanding the fund’s strategy, which threaten their long-term financial goals.

Final Thoughts

Building your investment portfolio around ETFs or mutual funds can provide substantial diversification and access to professional expertise. Carefully weighing their differences, from cost and tax treatment to trading mechanics, ensures your investments fit your unique circumstances and long-term ambitions.

Staying informed and vigilant pays off: research every option, verify fund holdings, and consider professional advice if needed. This discipline is the key to successful investing, helping you avoid common errors and maximize your returns over the years.