Key Takeaways

- Invoice factoring transforms unpaid invoices into immediate cash for businesses without adding debt.

- This strategy enhances cash flow, making sustaining operations and investing in growth easier.

- Suitable for industries facing long payment terms or cash flow challenges, including manufacturing, transportation, and service sectors.

- Companies should weigh costs, impacts on client relationships, and eligibility criteria before proceeding.

Understanding Invoice Factoring

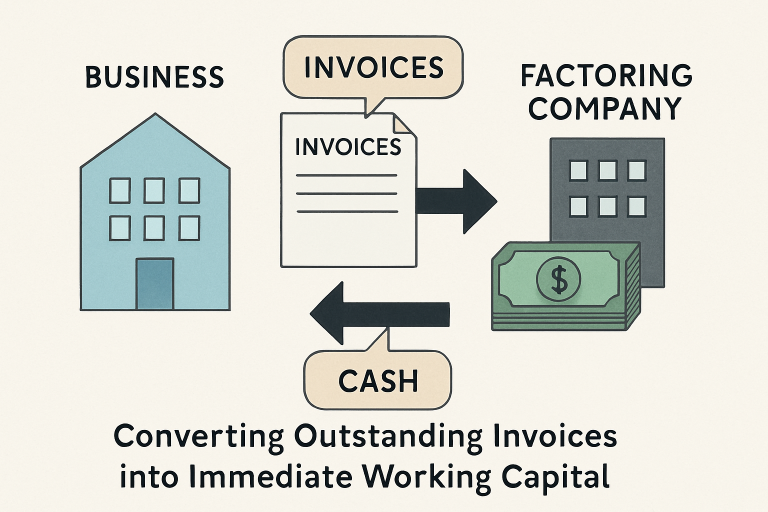

Managing cash flow is challenging for many businesses, especially when faced with lengthy payment terms from clients. Invoice factoring offers an effective solution, allowing companies to sell their outstanding invoices to a third-party factor at a discount. This enables immediate access to working capital for critical expenses, without waiting for clients to pay. For those seeking holistic support from a trusted partner, a trade finance loan company can facilitate the conversion of receivables into cash, helping to streamline operations and drive growth.

Unlike traditional loans that may increase debt and require collateral, invoice factoring provides liquidity without increasing balance sheet liabilities. This method is especially useful for small to mid-sized companies that need fast funding to sustain daily operations, hire employees, or seize new business opportunities.

How Invoice Factoring Works

The invoice factoring process is straightforward, making it a popular choice for organizations seeking transparency and speed:

- Issuing Services or Goods: The business delivers its products or services and sends invoices to customers, often with terms of 30, 60, or even 90 days.

- Selling the Invoice: Instead of waiting, the company sells these pending invoices to a factoring provider, receiving a quick advance—typically 70% to 90% of the invoice’s value.

- Receiving Funds: The factoring company deposits the advance, enabling the business to cover payroll, inventory, or other essential expenses immediately.

- Customer Payment: The factoring company collects payments directly from the invoiced customers when due.

- Final Payment and Fees: After collecting, the factor releases the remaining invoice value to the business, minus an agreed-upon service fee.

In essence, this method removes the time gap between service delivery and payment, which otherwise can hamper business momentum and limit investment potential. According to Investopedia, many growing businesses select factoring to free up resources and avoid constraints imposed by slow-paying clients.

Benefits of Invoice Factoring

Invoice factoring offers several distinct advantages:

- Better Cash Flow: Immediate payment for outstanding invoices allows enterprises to pay suppliers, plan updates, and unlock potential faster.

- Debt-Free Solution: Factoring is not a loan, so it doesn’t impact the company’s leverage or credit rating.

- Scalable and Flexible: This method grows with the business. Depending on needs, factoring can be used on specific invoices or as a regular funding mechanism.

- Operational Freedom: Releasing working capital provides more flexibility to respond to market changes, invest in promotions, or pursue new projects.

Industries Benefiting from Invoice Factoring

Several sectors stand to gain from invoice factoring’s unique structure and benefits:

- Manufacturing: Funding for ongoing projects and bulk material purchases without waiting on client payments reduces production bottlenecks.

- Transportation: Logistics and transport firms often deal with slow-paying clients while facing regular operational costs such as fuel and fleet maintenance. Factoring bridges this cash flow gap.

- Service Providers: Marketing agencies, consulting firms, and business service providers can use invoice factoring to cover payroll and project costs when clients extend payment cycles.

According to Forbes, these industries often experience long payment windows and cyclical cash flow challenges, making factoring an ideal financing solution.

Considerations Before Choosing Invoice Factoring

Despite its many advantages, factoring may not be ideal for every business. It’s important to weigh these key considerations:

- Fees and Costs: Factoring companies charge service fees that can reduce overall profit margins. The cost can vary widely depending on industry risk, invoice volume, and customer creditworthiness.

- Relationship Impact: Since customers will pay the factoring company directly, maintaining trust and transparency in client relationships is critical.

- Approval Criteria: Factors that evaluate your clients’ financial stability and payment reliability are more important than your own business. Businesses with creditworthy clients will generally receive better factoring terms.

Outstanding invoices represent trapped value in your business. While you’ve delivered goods or services, the cash remains inaccessible, creating a paradox: profitable on paper, cash-poor in practice. This guide explores how to transform these pending receivables into immediate working capital.

The Hidden Cost of Waiting

Every outstanding invoice carries an opportunity cost. Consider a €100,000 invoice with 60-day payment terms. While waiting, you cannot invest that capital in inventory, equipment, or growth initiatives. At a conservative 12% annual return on investment, this delay costs €2,000 in lost opportunities. Multiply this across your entire receivables portfolio, and the impact becomes substantial.

The cash conversion cycle—the time between paying suppliers and collecting from customers—determines your working capital needs. Most businesses operate with a 45-90 day gap, forcing them to bridge this period through reserves or external financing.

Invoice Financing: The Primary Solution

Factoring remains the most established method. You sell your invoices to a factoring company at a discount, typically receiving 80-90% immediately and the remainder (minus fees) when your customer pays. The factor assumes collection responsibility, making this particularly valuable for businesses lacking robust credit management.

Invoice discounting offers more control. You borrow against your invoice value while maintaining customer relationships and collection processes. This typically costs less than factoring but requires stronger internal credit management capabilities.

Selective invoice financing provides flexibility. Rather than committing your entire ledger, you choose specific invoices to finance. This works well for businesses with diverse customer profiles where only certain receivables need acceleration.

Modern Digital Solutions

Technology has democratized invoice financing. Platforms like MarketInvoice, Fundbox, and BlueVine use algorithms to assess creditworthiness within hours, not weeks. They analyze your accounting data, payment history, and customer profiles to offer instant financing decisions.

Supply chain finance represents an elegant solution for established relationships. Your customer’s bank pays you early at a discount, then collects the full amount from your customer at maturity. This leverages your customer’s superior credit rating, reducing financing costs.

Alternative Strategies

Dynamic discounting incentivizes early payment through graduated discounts. Offering 2% for payment within 10 days versus net 30 might seem expensive—effectively a 36% annual rate—but immediate cash often justifies this cost, especially when compared to overdraft rates or missed opportunities.

Asset-backed lending uses your entire receivables portfolio as collateral for a revolving credit facility. Unlike factoring, you maintain complete customer control while accessing up to 85% of eligible receivables value.

Revenue-based financing ties repayment to your income streams. While technically not invoice-specific, it provides working capital based on predictable receivables patterns, with repayments fluctuating with your cash flow.

Implementation Considerations

Successful receivables financing requires careful structuring. First, segment your invoices by customer creditworthiness, payment history, and dispute likelihood. Finance only clean, undisputed invoices from reliable customers.

Understand the true cost beyond the headline rate. Factor in service fees, credit protection charges, and the impact on customer relationships. Some customers view factoring negatively, potentially damaging commercial relationships.

Maintain transparency with stakeholders. Banks often require notification of factoring arrangements, as it affects their security position. Some customer contracts prohibit invoice assignment, requiring renegotiation before financing.

Optimizing the Process

Prevention beats cure. Tighten credit control through comprehensive customer vetting, clear payment terms, and proactive collection processes. The stronger your receivables quality, the better financing terms you’ll secure.

Consider graduated approaches. Start with selective financing for problem accounts, then expand as you understand the costs and benefits. Many businesses find optimal results using multiple solutions simultaneously—factoring for difficult accounts, discounting for regular customers, and dynamic discounting for strong relationships.

Technology integration streamlines operations. Modern accounting systems connect directly with financing platforms, automating the funding process. This reduces administrative burden and accelerates cash receipt.

Strategic Perspective

Invoice financing isn’t merely a cash flow tool—it’s a strategic lever. By accelerating receivables, you can accept larger orders, extend customer payment terms competitively, and pursue growth opportunities without diluting equity.

My opinion: Too many businesses view invoice financing as distressed funding, missing its strategic value. In industries with extended payment cycles—construction, manufacturing, wholesale—receivables financing should be built into the business model from inception, not added reactively during cash crunches. The cost of financing often pales against the opportunity cost of constrained growth.

The key lies in viewing outstanding invoices not as passive assets awaiting collection, but as active instruments capable of driving business growth. With proper structuring and strategic deployment, your receivables become a reliable source of working capital, transforming cash flow from constraint to competitive advantage.

Final Thoughts

Invoice factoring provides a powerful avenue for transforming unpaid invoices into immediate working capital, supporting a business’s liquidity without adding debt or requiring collateral. By understanding its mechanics, weighing associated benefits and considerations, and partnering with an experienced trade finance loan company, companies can enhance their operational freedom, smooth out cash flow cycles, and pursue their strategic goals more confidently.