Running a business on different sides of the Atlantic? You’re about to discover why your directory strategy can’t be a simple copy-paste job. Whether you’re expanding from Brooklyn to Birmingham or Manchester to Miami, the differences between US and UK directory ecosystems might surprise you.

Market-Specific Directory Landscapes

Let’s start with the obvious: Yelp dominates the US market at the same time as Yell holds court in the UK. But that’s just the tip of the iceberg. The real differences run much deeper than brand names.

In the US, Yelp processes over 178 million reviews across 5 million businesses. Meanwhile, Yell reaches 23 million UK users monthly – impressive for a country with one-fifth the population. But here’s where it gets interesting: UK businesses often see better conversion rates from directory traffic despite lower overall numbers.

Did you know? UK consumers are 40% more likely to contact a business directly from a directory listing compared to their US counterparts, who prefer reading multiple reviews first.

The directory ecosystem in each country reflects deeper cultural differences. Americans love choice – they’ll check Yelp, Google My Business, TripAdvisor, and Facebook before choosing a restaurant. Brits? They’re more likely to trust a single source and act on it.

Beyond the big names, regional players matter enormously. In the US, you’ve got Angie’s List for home services, Healthgrades for medical professionals, and Avvo for lawyers. The UK counters with Checkatrade for tradespeople, NHS Choices for healthcare, and The Law Society directory for solicitors.

What really throws businesses for a loop? The way these platforms integrate with daily life. Americans use Yelp like a social network – checking in, posting photos, building reviewer profiles. UK users treat Yell more functionally – they search, find, contact, done.

Platform Selection Criteria

Choosing the right platforms isn’t about throwing darts at a board. You need a calculated approach that considers your specific market dynamics.

For US markets, your needed platforms include:

- Google My Business (non-negotiable)

- Yelp (especially for restaurants, retail, and services)

- Industry-specific directories

- Facebook Business

- Apple Maps

UK businesses should prioritise:

- Google My Business (equally important)

- Yell.com

- Bing Places

- Thomson Local

- Industry directories like Checkatrade or Trustpilot

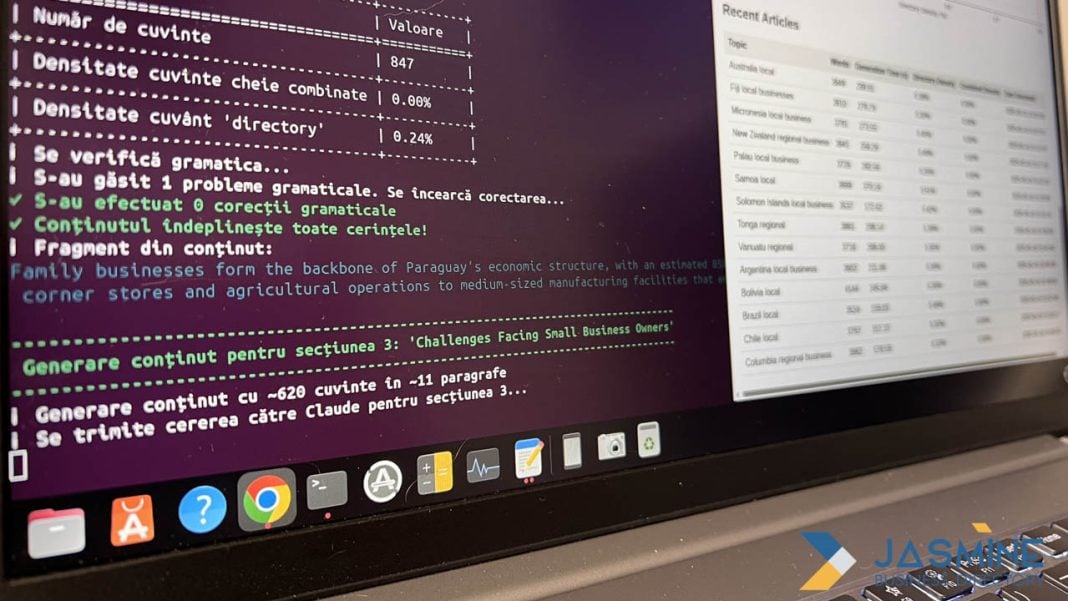

Quick Tip: Don’t ignore smaller, niche directories. A listing on Jasmine Web Directory might bring fewer visitors than Yelp, but they’re often more qualified leads.

The selection process differs significantly between markets. US businesses must consider platform popularity by state – Yelp dominates California but might be less relevant in rural Montana. UK businesses face a more uniform area, though London-based companies might prioritise Time Out at the same time as Manchester businesses focus on local directories.

Cost structures vary wildly too. Yelp’s advertising starts around $300 monthly for basic visibility. Yell’s enhanced listings begin at £50 monthly – but don’t let the lower price fool you. The ROI calculation changes completely when you factor in market size and competition levels.

Local SEO Optimization Differences

Here’s where things get properly technical. Google might be the same company, but local SEO works differently across the pond.

US local searches often include state abbreviations (pizza NYC, plumber LA). UK searches favour postcodes (electrician SW1, dentist M1). This seemingly minor difference impacts everything from keyword research to content creation.

| SEO Factor | US Approach | UK Approach |

|---|---|---|

| Location Keywords | City + State (Denver, CO) | City + Postcode (Leeds LS1) |

| Review Quantity Focus | Volume matters most | Quality over quantity |

| Citation Sources | NAP consistency across 50+ sites | Focus on 20-30 key sites |

| Mobile Optimisation | Voice search priority | Speed and simplicity |

Americans search differently than Brits. US consumers use longer, more conversational queries (“best Italian restaurant near me with outdoor seating”). UK searchers prefer brevity (“Italian restaurant Birmingham”).

Myth: You can use the same SEO strategy for both markets.

Reality: UK local packs show different information, prioritise different signals, and even display results in different formats.

The technical implementation varies too. US businesses benefit from schema markup indicating service areas across multiple states. UK businesses should focus on precise postcode targeting and regional dialect variations (think “lawyer” vs “solicitor”).

Review Management Strategies

Reviews make or break businesses, but the approach to managing them couldn’t be more different between markets.

According to discussions on Reddit about Google’s review policies, businesses can flag reviews but can’t simply delete negative feedback. This applies globally, but the response strategies differ dramatically.

US consumers expect businesses to respond to every review – positive or negative. They want personality, engagement, sometimes even humour. A restaurant owner in Brooklyn might respond to a negative review with “Sorry we missed the mark! Come back for a free appetiser and let us make it right!”

UK consumers prefer professional, measured responses. That same negative review in Bristol might get: “We apologise for not meeting your expectations. Please contact us directly to discuss how we can improve your experience.”

Did you know? Reddit users report that Google reviews have overtaken Yelp for restaurant searches in many US cities, during UK users still rely heavily on TripAdvisor for dining decisions.

The volume expectations differ too. A US business with fewer than 50 reviews looks suspicious. UK consumers start trusting businesses with as few as 10-15 quality reviews. This impacts your review generation strategy significantly.

Review velocity matters differently. US businesses need steady, continuous reviews – going three months without a new review can hurt rankings. UK businesses can maintain credibility with less frequent but more detailed reviews.

Category Taxonomy Variations

You’d think a restaurant would be categorised the same way everywhere. Think again.

US directories love micro-categories. On Yelp, you’re not just a restaurant – you’re a “Gastropub specialising in Farm-to-Table New American Cuisine with Craft Cocktails.” UK directories prefer broader strokes: “Restaurant – Modern British.”

This affects discoverability profoundly. US businesses benefit from claiming multiple ultra-specific categories. Too many categories in the UK? You look desperate or confused.

Success Story: A British fish and chips shop expanding to Boston initially listed itself under “Fish & Chips” – a category with minimal search volume in the US. After recategorising as “Seafood Restaurant” and “British Pub,” foot traffic increased 300% within two months.

Professional services face even bigger challenges. US “attorneys” become UK “solicitors” or “barristers.” US “realtors” transform into UK “estate agents.” Get these wrong, and you’re invisible to your target market.

The taxonomy extends to service descriptions. Americans search for “cell phone repair,” Brits want “mobile phone repair.” “Apartment rentals” vs “flat lettings.” “Parking lot” vs “car park.” These aren’t just vocabulary differences – they’re serious SEO considerations.

Advertising Cost Comparisons

Money talks, but it speaks different languages in each market.

Yelp advertising in major US cities can run $1,000-$5,000 monthly for competitive categories. Premium placements in New York or San Francisco? Budget $10,000+ for meaningful visibility. Yell’s enhanced listings seem bargain-priced at £200-£1,000 monthly, but remember – you’re reaching a smaller audience.

| Platform | US Average Cost | UK Average Cost | Typical ROI |

|---|---|---|---|

| Premium Listings | $500-2,000/month | £100-500/month | US: 3:1, UK: 4:1 |

| Pay-Per-Click | $2-15/click | £0.50-5/click | Varies by industry |

| Enhanced Profiles | $300-800/month | £50-200/month | US: 2:1, UK: 3:1 |

But raw costs tell only part of the story. US markets typically require advertising across multiple platforms simultaneously. UK businesses often see better results concentrating spend on fewer platforms.

What if you have a limited budget? In the US, focus on Google Ads and organic Yelp optimisation. In the UK, a enhanced Yell listing plus Google My Business might deliver better results than spreading thin across multiple platforms.

The bidding strategies differ too. US platforms favour aggressive bidding for top positions. UK advertisers often find better value in second or third positions, as British consumers are more likely to compare multiple options before deciding.

Mobile Usage Patterns

Mobile changes everything, but not equally everywhere.

Americans conduct 76% of local directory searches on mobile devices. Brits? 82%. That six percent difference might seem minor, but it primarily changes design priorities.

US mobile users expect feature-rich experiences. They want to browse photos, read lengthy reviews, check real-time availability, and message businesses directly through apps. UK users prioritise speed and simplicity – show them contact details and directions, fast.

Quick Tip: US directory profiles should include extensive photo galleries. UK profiles perform better with fewer, higher-quality images that load quickly on mobile.

App usage varies dramatically. Yelp’s app commands massive US market share – many users never visit the website. UK users split between mobile web and apps, with older demographics strongly preferring mobile websites to downloading another app.

The “near me” phenomenon works differently too. US “near me” searches cast a wider net – users might consider businesses 10-15 miles away. UK “near me” searches expect results within 2-3 miles, reflecting denser urban planning and different transport habits.

Voice search adoption shows interesting patterns. Americans use voice search for discovery (“Hey Siri, find the best Mexican restaurant nearby”). Brits use voice search for specific queries (“OK Google, call Domino’s Pizza in Reading”).

Regulatory Compliance Requirements

Legal requirements add layers of complexity to directory strategies.

GDPR transformed UK directory practices. Businesses must carefully manage customer data, obtain explicit consent for marketing, and provide clear opt-out mechanisms. US businesses face a patchwork of state regulations – California’s CCPA mirrors some GDPR requirements, but Texas plays by different rules.

Did you know? UK businesses face fines up to £17.5 million for GDPR violations in directory data handling, while US penalties vary dramatically by state.

Review regulations differ significantly. The UK’s Competition and Markets Authority strictly prohibits fake reviews and requires disclosure of incentivised feedback. The US Federal Trade Commission has similar rules but enforcement varies by state.

Industry-specific requirements add complexity. UK financial services must include FCA registration numbers in directory listings. US healthcare providers navigate HIPAA compliance for patient testimonials. Get these wrong, and you’re not just invisible – you’re illegal.

Accessibility requirements increasingly matter. US directories must comply with ADA standards. UK platforms follow WCAG guidelines. This affects everything from image alt text to colour contrast in your listings.

Key Insight: Compliance isn’t just about avoiding fines. Properly implemented regulatory requirements can become competitive advantages, showing professionalism and trustworthiness.

Future Directions

The directory market won’t stand still. Smart businesses prepare for what’s coming.

AI integration accelerates differently in each market. US platforms experiment with chatbots, automated booking, and predictive recommendations. UK directories focus on improving search accuracy and reducing spam.

Social proof evolution takes divergent paths. Americans increasingly value video reviews and influencer endorsements. Brits prefer detailed written reviews from verified purchasers. Plan your content strategy because of this.

The platforms themselves face disruption. Google’s dominance in local search challenges traditional directories. New players like Nextdoor in the US and Neighbourly in the UK blur lines between social networks and business directories.

Action Checklist for Cross-Atlantic Success:

- Audit current directory presence in both markets

- Localise all content – don’t just change spellings

- Establish market-specific review generation strategies

- Budget appropriately for each market’s advertising costs

- Ensure regulatory compliance in all jurisdictions

- Monitor emerging platforms and features

- Test and measure performance metrics separately

What’s next? Expect augmented reality integration, allowing customers to visualise products or preview restaurants through directory apps. Expect tighter integration between directories and delivery platforms. Expect privacy regulations to reshape data collection and targeting.

The businesses that thrive won’t be those with the biggest budgets or most listings. Success belongs to those who understand that effective directory strategy means speaking the local language – literally and figuratively. Whether you’re conquering New York or Newcastle, the principles remain constant: understand your market, optimise for local behaviour, and deliver value that transcends borders.

Ready to expand internationally? Start with solid research, test small, and scale what works. The Atlantic might be wide, but with the right directory strategy, your business can bridge it successfully.