The Bank of England stands as one of the world's oldest and most influential central banks, having shaped monetary policy and financial stability for over three centuries. Established in 1694 to act as the government's banker and manage England's growing national debt, the institution has evolved into a complex organization responsible for maintaining the stability of the UK's financial system. Often referred to as the "Old Lady of Threadneedle Street" due to its historic location in the City of London, the Bank operates as an independent public body whilst remaining wholly owned by the UK government through the Treasury Solicitor.

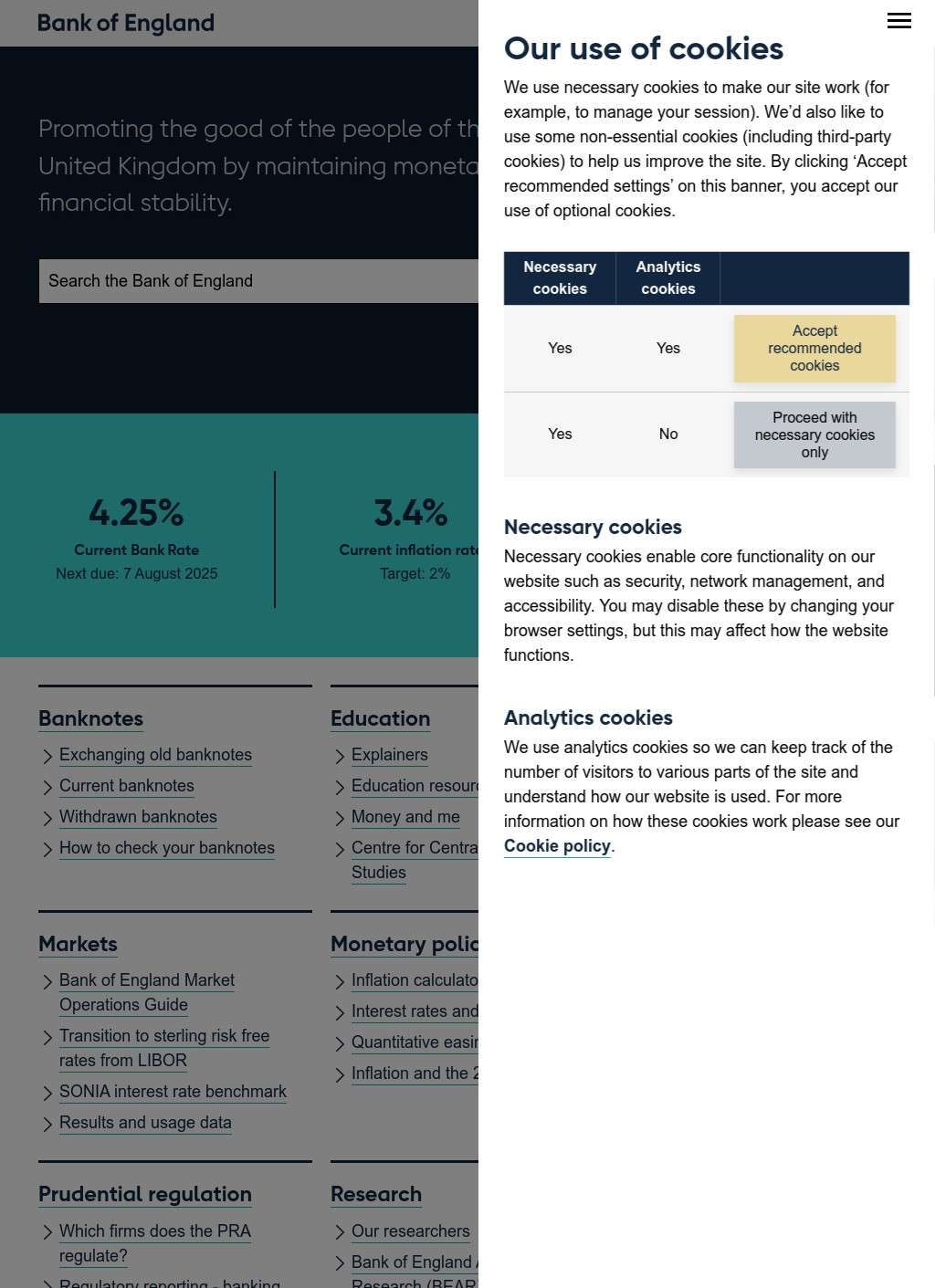

At its core, the Bank of England serves two primary objectives: maintaining monetary stability through price stability, and ensuring financial stability across the UK's financial system. The monetary stability mandate involves keeping inflation at the government's target of 2% per year, primarily through the setting of interest rates. The Monetary Policy Committee (MPC), a nine-member body led by the Governor, meets eight times annually to determine the appropriate level of Bank Rate – the interest rate that influences all other rates throughout the economy. This committee analyzes vast amounts of economic data, from employment figures to global commodity prices, to make decisions that affect everything from mortgage rates to business investment.

The Bank's financial stability responsibilities encompass a broad range of activities designed to ensure the financial system can continue serving households and businesses even during periods of stress. Through the Financial Policy Committee (FPC), the Bank identifies and monitors systemic risks that could threaten the stability of the UK financial system. This might involve requiring banks to hold additional capital buffers during economic booms or taking action to cool overheating property markets. The Bank also operates as the UK's resolution authority, meaning it has powers to manage the failure of banks and other financial institutions in ways that minimize disruption to the wider economy.

As a regulator, the Bank of England through its Prudential Regulation Authority (PRA) supervises approximately 1,500 banks, building societies, credit unions, insurers, and major investment firms. This supervision involves regular assessments of firms' financial health, governance arrangements, and risk management practices. The PRA works closely with the Financial Conduct Authority, which handles conduct regulation, to ensure comprehensive oversight of the financial sector. The Bank's approach to regulation has evolved significantly since the 2008 financial crisis, with greater emphasis on stress testing, recovery planning, and ensuring firms can fail safely without requiring taxpayer bailouts.

The Bank of England maintains several critical functions that underpin the UK's financial infrastructure. It operates the Real Time Gross Settlement (RTGS) system, through which over £700 billion worth of transactions flow daily – equivalent to the UK's quarterly GDP passing through the system every three days. The Bank also manages the issuance and distribution of banknotes for England and Wales, with over £80 billion worth of notes currently in circulation. Advanced security features and regular design updates help maintain confidence in the currency and combat counterfeiting.

International engagement forms a crucial aspect of the Bank's work in an increasingly interconnected global economy. The Bank participates actively in international forums such as the Bank for International Settlements, the Financial Stability Board, and various committees of central bank governors. It maintains close working relationships with other central banks, particularly the European Central Bank and the Federal Reserve, coordinating on matters ranging from financial stability to payment systems. The Bank also provides banking services to over 100 overseas central banks, maintaining their sterling reserves and facilitating international transactions.

The Bank's balance sheet operations have become increasingly prominent since the 2008 financial crisis. Through its Asset Purchase Facility, the Bank has conducted several rounds of quantitative easing, purchasing government and corporate bonds to provide monetary stimulus when interest rates approached zero. At its peak, these holdings exceeded £895 billion. The Bank has also operated various lending schemes to support bank lending to businesses and households, demonstrating how central banking tools have evolved beyond traditional interest rate policy.

Research and analysis underpin all of the Bank's policy functions. Teams of economists, researchers, and market analysts work to understand economic trends, financial market developments, and emerging risks. The Bank publishes extensive research, from working papers on monetary theory to practical guides for financial institutions. Its quarterly Monetary Policy Report and twice-yearly Financial Stability Report provide comprehensive assessments of economic conditions and financial system risks, serving as key reference documents for policymakers, financial professionals, and academics worldwide.

For businesses and institutions needing to engage with the Bank of England, multiple channels exist depending on the nature of the interaction. Financial institutions subject to PRA regulation have dedicated supervisory contacts, while those seeking information about monetary policy or financial stability can access extensive resources through the Bank's website. The Bank maintains a public enquiries service for general questions and operates specialist helplines for matters such as banknote authentication. Physical locations include the headquarters on Threadneedle Street and operational sites managing cash distribution and other functions.

Recent years have seen the Bank of England grappling with unprecedented challenges, from managing the economic fallout of the COVID-19 pandemic to addressing the implications of Brexit for UK financial services. The Bank has also been exploring fundamental questions about the future of money, including researching the potential for a central bank digital currency that could complement physical cash. Climate change has emerged as another key focus area, with the Bank integrating climate risk considerations into its supervisory approach and conducting climate stress tests of major financial institutions. These evolving responsibilities demonstrate how the Bank continues to adapt its 330-year-old mission to meet the needs of a modern economy.