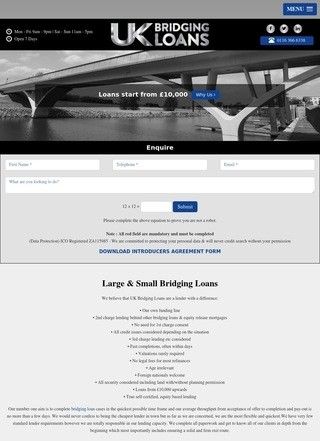

UK Bridging Loans is a financial service that specializes in offering bridging loans at impressively low rates. They offer a unique financial solution that is typically shorter-term than most standard loans and can offer immediate cash flow. This service is particularly beneficial when it comes to bridging the financial gap that arises when purchasing property while waiting to sell an existing one.

One of the core offerings of UK Bridging Loans is their ability to provide fast and highly flexible bridging loans. Their service has been designed with speed in mind, often providing loan completion within just a few days. This can prove to be a important advantage when time is a critical factor in a property transaction.

UK Bridging Loans offer a variety of loan options to suit various circumstances and needs. They cater to both individuals and businesses, and their loans can range from ₤25,500 upwards. For instance, they offer loans for land, either with or without planning, and second or third charge loans. In addition, they also consider clients with adverse credit history and allow loans for individuals up to the age of 85.

Another significant advantage of this service is the capacity for pure equity-based lending. Unlike many traditional loans, they can offer valuation-free funding. This means that residential and commercial valuations are not always necessary, allowing for a smoother and more efficient lending process.

UK Bridging Loans also provide a free legal option, which takes away some of the stress and financial burden often associated with taking out a loan. Furthermore, no monthly repayments are required, which means that customers are offered a substantial level of flexibility when it comes to managing their loan repayments.

Their services have been rated highly by customers, scoring 4.7 out of 5. One of the main reasons for their high rating is likely the wide range of scenarios in which their services can be utilized. As well as assisting customers when purchasing a new home, their loans can be useful in property development cases. Developers often find a bridging loan valuable for securing necessary financing promptly, which can be essential in competitive property development markets.

In conclusion, UK Bridging Loans provides a specialized, fast, and innovative solution for bridging loan financing with a variety of options that can cater to a broad range of needs. With the company's commitment to flexibility and speedy service, it is an excellent option for anyone seeking immediate cash flow in the property sector, regardless of their particular scenario or financial circumstances.

Business address

Unit 2c, Kibworth Business Park

Kibworth Harcourt,

Leicestershire

LE8 0EX

United Kingdom

Contact details

Phone: 0116 3666338