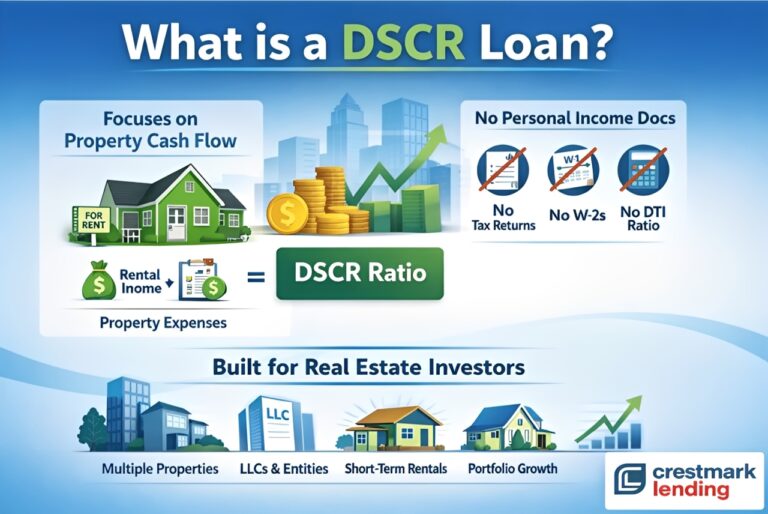

Crestmark Lending operates in the real estate investment financing space, focusing exclusively on DSCR loans—that's Debt Service Coverage Ratio for anyone new to investor-speak. Unlike traditional mortgages that dig into your personal income, tax returns, and employment history, DSCR lending takes a different approach. The property itself does the talking. If the rental income covers the mortgage payment, you're in the game. It's a model that makes sense for investors who might have complicated tax situations or multiple income streams that don't look great on paper.

The company positions itself as a mortgage broker rather than a direct lender, which gives them access to over 20 wholesale DSCR programs. This setup lets them shop around for better rates and terms on behalf of their clients. In my opinion, this broker model works well for investors because DSCR products can vary wildly from lender to lender. Having someone who knows where to look can save both time and money.

Their loan menu covers the basics you'd expect—purchase and refinance—but also branches into specialized territory. Multifamily properties with two to four units qualify under their programs. They handle LLC-owned properties too, which is a big deal for investors who want liability protection and cleaner accounting across their portfolios. The ability to close in an entity name rather than personally removes a step many investors would otherwise need to handle post-closing.

For investors looking to add value, Crestmark offers renovation and rehab financing where improvement costs get rolled into the loan. New construction loans are available for build-to-rent projects, with the option to transition into long-term DSCR financing once the property is completed. Jumbo loans round out the offerings, going up to $5 million for larger rental assets or experienced investors scaling up their holdings.

The qualification requirements stay pretty straightforward. Most programs ask for a credit score of 660 or higher and a DSCR ratio of at least 1.0, meaning the rent equals or exceeds the monthly payment. Some lenders in their network will work with ratios below 1.0, though that usually means higher pricing or stronger compensating factors like more cash reserves. Loan amounts reach up to $3 million for standard deals, with cash-out refinances topping out around $1 million or 80% loan-to-value.

What sets this company apart, as a reviewer, is their focus on speed. They aim to close loans within 21 days, which aligns with how competitive real estate markets actually work. Missing a closing deadline because your lender moved too slow is a real concern for investors, especially in bidding situations where sellers want certainty. The streamlined documentation process—no W-2s, no pay stubs, no tax return reviews—helps keep things moving.

Short-term rental investors aren't left out of the conversation either. Airbnb and VRBO properties qualify under their programs, which matters because not every lender touches vacation rentals. The underwriting can accommodate projected rental income from short-term platforms, though lease documentation or rental history helps strengthen the file.

Crestmark provides a DSCR calculator on their website, letting potential borrowers run numbers before reaching out. They also publish educational content covering topics like refinance strategies and Airbnb financing, which helps investors understand their options before committing to a conversation. The team includes licensed loan officers with NMLS credentials, and the company operates across multiple states including Texas, Florida, Colorado, Oklahoma, Arkansas, and Louisiana.

For real estate investors who've hit walls with traditional financing—whether due to self-employment, multiple properties, or just wanting to scale faster—DSCR lending offers a path forward. Crestmark Lending has built its entire operation around this niche, and that specialization shows in how they structure their programs and communicate with their target audience.

Business address

Crestmark Lending

1560 E Southlake Blvd., Suite 10,

Southlake,

TX

76092

United States

Contact details

Phone: 8666558060