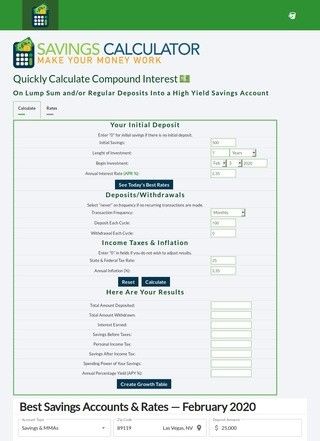

The Savings Calculator tool provides a comprehensive solution to help users better manage and plan their financial goals. It covers a wide range of savings scenarios, from Retirement and IRA to College and CDs. The user-friendly feature allows for users to input various forms of initial deposits by selecting either lump sum amounts or regular deposits.

The design of the calculation process is user-oriented providing options for the length of investment in different units, from days to centuries. This enables a highly-customizable environment for users to plan their savings according to their personal circumstances. The calculator also takes into account the annual interest rate, allowing users to better predict their expected savings outcomes.

The calculator also goes the extra mile to include options for users to determine transaction frequencies and amounts. This provides a deeper insight into recurring transactions, assisting users in balancing their deposits and withdrawals.

Additionally, the calculator integrates factors such as income taxes and inflation, to offer a more precise calculation. Users have to enter their state and federal tax rate as well as the annual inflation rate. This takes into consideration the financial implications that could potentially impact their savings.

The results generated by the calculator are comprehensive, breaking down the total amount deposited, withdrawn, and the interest earned. It further calculates the user's personal income tax, savings before and after tax, and the spending power of the savings. The results section also displays the Annual Percentage Yield (APY%), a vital piece of information that can guide future savings strategies.

The calulator also offers information about investing in Series I Savings Bonds. It educates users about certain financial trends, such as the slow pace of most commercial banks in following the Federal's Reserve's aggressive interest rates in 2022.

Overall, the Savings Calculator provides a detailed, customizable solution to help users strategize and manage their savings, incorporating various factors to ensure users can make well-informed financial decisions.