The Commodity Futures Trading Commission represents a crucial regulatory pillar in the American cryptocurrency landscape, wielding authority over digital assets classified as commodities rather than securities. This independent federal agency, born from agricultural roots in 1974, has transformed into a sophisticated overseer of complex financial derivatives markets. When Bitcoin emerged as a new asset class, the CFTC quickly recognized its commodity-like characteristics and asserted jurisdiction over futures contracts and derivatives based on cryptocurrencies.

The commission's approach to cryptocurrency differs fundamentally from that of its regulatory sibling, the SEC. Where the SEC focuses on tokens that function as investment contracts, the CFTC oversees cryptocurrencies that behave more like traditional commodities - digital equivalents to gold, oil, or wheat. The agency formally declared Bitcoin a commodity in 2015, later extending this classification to Ethereum and other established cryptocurrencies. This designation brings crypto derivatives under the CFTC's comprehensive regulatory framework, subjecting them to rules designed to prevent manipulation and ensure market integrity.

Operating through multiple specialized divisions, the CFTC maintains vigilant oversight of cryptocurrency derivatives markets. The Division of Market Oversight monitors exchanges offering crypto futures and options, ensuring compliance with position limits and reporting requirements. The Division of Enforcement pursues cases against bad actors who manipulate crypto markets or operate illegal derivatives platforms. Recent enforcement actions have targeted unregistered Bitcoin futures platforms, fraudulent commodity pools investing in crypto, and schemes involving wash trading or spoofing in digital asset markets.

For cryptocurrency exchanges, the CFTC's regulatory requirements create a detailed compliance landscape. Platforms offering futures, options, or swaps on digital assets must register as designated contract markets (DCMs) or swap execution facilities (SEFs). These registrations come with extensive obligations - maintaining adequate financial resources, implementing robust surveillance systems, and providing transparent price discovery mechanisms. The commission also oversees clearinghouses that process crypto derivatives trades, ensuring they maintain sufficient capital to manage counterparty risks.

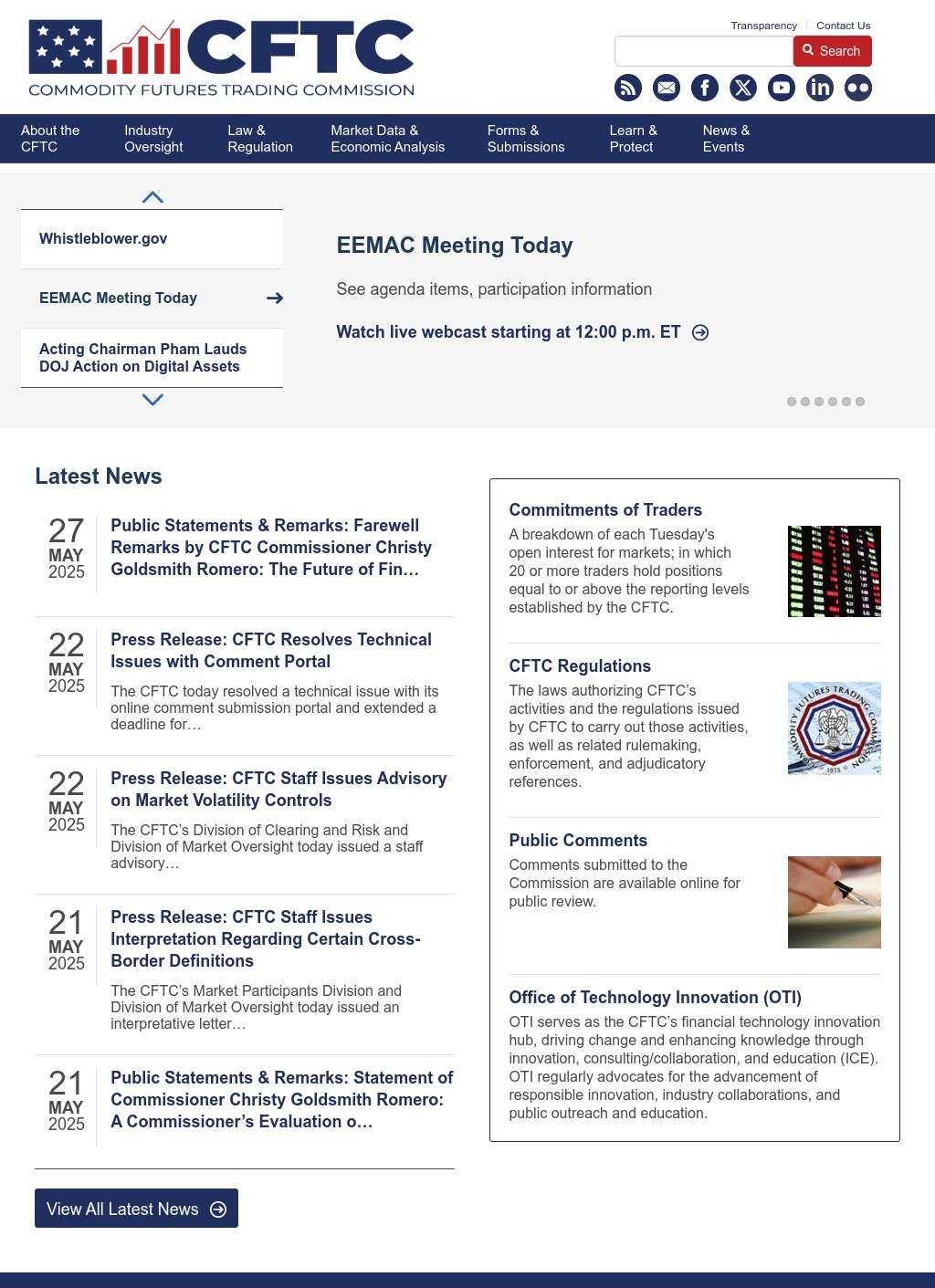

The agency provides substantial educational resources through its digital assets webpage and LabCFTC initiative. These platforms offer guidance on virtual currencies, explain the risks of crypto derivatives trading, and clarify which activities fall under CFTC jurisdiction. The commission has published primers on virtual currencies, customer advisories warning about crypto scams, and detailed explanations of how traditional commodity regulations apply to digital assets. LabCFTC serves as the agency's fintech innovation hub, engaging with blockchain developers and crypto entrepreneurs to understand emerging technologies.

Enforcement remains a cornerstone of the CFTC's crypto oversight strategy. The commission has brought significant cases against cryptocurrency exchanges operating without proper registration, including the landmark BitMEX settlement that resulted in $100 million in penalties. The agency pursues retail fraud cases involving fake crypto investment schemes, Ponzi structures built on digital assets, and precious metals dealers illegally leveraging cryptocurrency. These enforcement actions establish clear boundaries for acceptable market conduct and demonstrate the CFTC's commitment to protecting market participants.

The jurisdictional boundaries between the CFTC and SEC create ongoing challenges for the cryptocurrency industry. While Bitcoin and Ethereum clearly fall under CFTC oversight as commodities, many other tokens exist in a regulatory gray zone. The agencies sometimes disagree on classification, leading to uncertainty for exchanges and token issuers. Proposed legislation in Congress aims to clarify these boundaries, potentially expanding the CFTC's role in overseeing spot cryptocurrency markets beyond just derivatives. Until such clarity arrives, market participants must navigate carefully between the two regulatory regimes.

The CFTC's approach to cryptocurrency regulation emphasizes market integrity and customer protection while acknowledging the innovative potential of blockchain technology. The commission has approved regulated futures contracts on Bitcoin and Ethereum, providing institutional investors with compliant vehicles for crypto exposure. Self-certification procedures allow exchanges to list new crypto derivatives products, though the CFTC retains authority to intervene if products threaten market stability. This balance between innovation and oversight shapes how derivatives markets develop around digital assets.

International coordination plays an increasingly important role in the CFTC's crypto oversight efforts. Digital assets trade globally across borders, requiring regulatory cooperation to prevent arbitrage and ensure consistent standards. The commission works closely with counterparts in the UK, EU, and Asia to share information and coordinate enforcement actions. Cross-border issues become particularly complex when dealing with decentralized protocols and smart contracts that operate without traditional intermediaries.

The commission maintains extensive public databases documenting its regulatory and enforcement activities. Weekly Commitments of Traders reports now include data on Bitcoin futures positions, providing transparency into market dynamics. Enforcement action archives detail cases involving cryptocurrency, establishing precedents for acceptable conduct. The CFTC's website offers real-time updates on new regulations, proposed rules, and guidance affecting digital asset markets. These resources help market participants understand compliance obligations and track regulatory developments.

Contact channels with the CFTC remain open and accessible for various stakeholders. The commission operates a toll-free hotline for reporting suspected violations involving cryptocurrency derivatives. The whistleblower program offers monetary rewards for information leading to successful enforcement actions, with specific provisions protecting crypto-related tipsters. Regional offices in New York, Chicago, and Kansas City maintain staff specializing in digital asset matters. Business hours follow federal government schedules, with emergency contacts available for time-sensitive market issues.

Through its balanced yet firm approach to cryptocurrency derivatives regulation, the CFTC has established itself as a pragmatic voice in digital asset oversight. The agency's willingness to approve regulated crypto futures products demonstrates openness to innovation, while aggressive enforcement against bad actors shows commitment to market integrity. As cryptocurrency markets mature and new derivatives products emerge, the CFTC's role will likely expand, particularly if Congress grants additional authority over spot crypto markets. The commission's actions today are shaping the foundation for how digital asset derivatives will trade for decades to come.